What is an embedded deductible how does it work? This question delves into a crucial aspect of many insurance policies, particularly health insurance. Embedded deductibles are a unique way to structure insurance coverage, blending with the overall policy to influence how claims are handled and how costs are managed. Understanding how these deductibles function is essential for anyone navigating health insurance plans, as they can significantly impact your out-of-pocket expenses.

This post will explore the intricacies of embedded deductibles, comparing them to traditional ones. We’ll dissect how they operate, providing examples to illustrate their impact on healthcare costs and premium structures. Expect a clear explanation, backed by detailed comparisons and practical case studies, so you can make informed decisions about your insurance choices.

Defining Embedded Deductibles

Embedded deductibles are a clever way healthcare plans structure their costs. Instead of having a single, upfront deductible, these plans integrate a portion of the deductible into the cost of individual services. This can lead to a more predictable and potentially less daunting experience for consumers. Understanding the difference between embedded and traditional deductibles is crucial for making informed healthcare decisions.This approach to structuring healthcare costs has distinct advantages and disadvantages compared to traditional methods.

An embedded deductible works like a hidden cost, often bundled into a health insurance plan. It’s a bit like budgeting for a low carb diabetes diet – you’re already factoring in some expenses upfront. Sometimes, those expenses are related to specific conditions like a low carb diabetes diet or just general health maintenance. It’s important to understand how it works to avoid any surprises when it comes to paying for medical care.

Ultimately, an embedded deductible aims to help manage overall healthcare costs.

By understanding the mechanics and common uses of embedded deductibles, you can navigate your healthcare plan more effectively.

Key Characteristics of Embedded Deductibles

Embedded deductibles are a type of cost-sharing mechanism where a portion of the deductible is applied directly to each medical service. This differs significantly from traditional deductibles, which require a specific amount to be met before coverage begins. A key characteristic is the seamless integration of the deductible into the pricing of individual services. This often results in predictable out-of-pocket costs.

For example, a plan might have a $1,000 embedded deductible for doctor visits, which is factored into the price of each visit. The consumer pays a lower amount for each visit, but the total deductible is still $1,000.

Distinguishing Embedded from Traditional Deductibles

Embedded deductibles are distinguished from traditional deductibles by their method of application. Traditional deductibles require the accumulation of a set amount before any insurance coverage kicks in. Embedded deductibles, conversely, apply a portion of the deductible to each service. This difference significantly impacts the patient’s experience and the predictability of out-of-pocket costs.

Common Situations Where Embedded Deductibles Are Utilized

Embedded deductibles are commonly found in plans that aim to provide predictable costs for routine medical services. This is often seen in PPO (Preferred Provider Organization) plans. They are also becoming increasingly popular in high-deductible health plans (HDHPs) and consumer-driven health plans. In these plans, the goal is to encourage proactive management of healthcare costs by incorporating the deductible into the cost of each visit or procedure.

This predictability can make it easier to budget for healthcare expenses.

Comparison of Embedded and Traditional Deductibles, What is an embedded deductible how does it work

| Feature | Embedded Deductible | Traditional Deductible |

|---|---|---|

| Application | Portion of deductible applied to each service. | Deductible amount accumulated before any coverage. |

| Cost Predictability | Generally more predictable out-of-pocket costs. | Cost predictability varies, depending on the frequency of medical services. |

| Patient Experience | Can be more straightforward for managing costs. | May lead to surprise costs if the patient incurs multiple services. |

| Plan Type | Often found in PPOs, HDHPs, and consumer-driven health plans. | Common in various health insurance plans. |

How Embedded Deductibles Function: What Is An Embedded Deductible How Does It Work

Embedded deductibles are a crucial component of many insurance policies, impacting how claims are processed. They differ from traditional deductibles in their application, often being built into the policy structure rather than a separate, upfront payment requirement. Understanding their mechanics is essential for navigating the claim process effectively.Embedded deductibles operate subtly within the claim settlement process. Instead of a separate, upfront payment, the deductible amount is automatically deducted from the policy’s payout.

This approach integrates the deductible into the policy’s coverage calculation, which simplifies the claim settlement process for both the insurer and the policyholder.

Mechanics of Application

Embedded deductibles are designed to streamline the claim settlement process. Instead of requiring a separate payment, the deductible is automatically applied to the claim amount. The insurance company deducts the embedded deductible from the total claim amount before calculating the payout to the policyholder. This process often happens behind the scenes, making it seem seamless.

Steps Involved in Applying an Embedded Deductible

A claim involving an embedded deductible typically follows these steps:

- The policyholder submits a claim to the insurance company.

- The insurance company assesses the claim, verifying its validity and the associated costs.

- The insurance company calculates the total claim amount.

- The embedded deductible amount is automatically subtracted from the total claim amount.

- The insurance company calculates the final payout to the policyholder.

Timing of Deductible Application

The timing of embedded deductible application can vary depending on the type of claim. For example, in property damage claims, the deductible might be applied directly to the repair costs. In medical claims, the deductible might be applied to the overall medical expenses incurred. The policy’s specific language will clarify the timing of application for each type of claim.

Sequential or Combined Application

In some instances, an embedded deductible might be applied sequentially to different coverages or in combination with other policy provisions. For example, a policy might have an embedded deductible for property damage and another for liability claims. These separate deductibles might be applied in stages, depending on the specific claim. Policies might also combine embedded deductibles with other forms of coverage, such as co-pays or coinsurance.

Step-by-Step Process for Understanding Application

To grasp the application of an embedded deductible, follow these steps:

- Review your policy documents: Carefully examine your insurance policy, noting the specific language regarding embedded deductibles. Pay close attention to the definitions of different types of claims and how deductibles are applied in each scenario.

- Understand the claim process: Familiarize yourself with the claim submission process for your specific insurance policy. Understand the required documentation and timelines.

- Calculate the potential payout: Use the policy documents and claim details to estimate the potential payout. This will help you understand how the embedded deductible affects the final payout amount.

Examples and Scenarios

Embedded deductibles, while often invisible to consumers, significantly impact healthcare costs and insurance premiums. Understanding how they operate in various insurance products is crucial for making informed decisions. This section will illustrate the practical application of embedded deductibles, showcasing their influence on healthcare expenses and insurance pricing.

Health Insurance Plans

Health insurance plans are a prime example of where embedded deductibles are prevalent. Premiums might seem low, but substantial out-of-pocket expenses are often hidden within the plan. For instance, a plan with a seemingly low monthly payment might have a high embedded deductible for specific procedures like specialized surgeries or extensive hospital stays. This upfront cost burden can create a significant financial barrier for individuals facing unexpected health crises.

These hidden costs aren’t always apparent at the time of plan selection.

Dental Insurance

Dental insurance policies frequently utilize embedded deductibles. These plans often require a certain amount of expenses to be met before coverage kicks in. For instance, a policy might cover 80% of the cost of a root canal after the insured individual has met a $250 deductible. This means that the initial costs of preventative care or basic procedures are borne entirely by the policyholder, whereas more complex procedures are partially covered.

This approach aims to control costs for the insurance provider.

An embedded deductible is a bit like a hidden cost in your health insurance plan. It’s a specific amount you pay out-of-pocket before your insurance kicks in. For example, if you have a breast cancer lump in armpit and need a lot of testing, the embedded deductible might apply. This condition can sometimes require a series of procedures, and you’ll want to know how your deductible works.

Understanding the specifics of your embedded deductible is crucial for managing medical costs. You’ll need to know how much it is and how it works with your particular plan.

Vision Insurance

Vision insurance policies often include embedded deductibles for eye exams, glasses, or contacts. A common example is a plan requiring the policyholder to pay a certain amount for an eye exam before the insurance covers a portion of the cost. The amount of the deductible can vary widely between plans, making comparisons important when selecting a vision care policy.

These deductibles can influence the frequency of preventative eye care.

The table below illustrates how embedded deductibles impact different healthcare claim scenarios. It shows how the amount paid by the insured individual varies based on the claim type and the deductible amount.

| Claim Type | Deductible Application | Impact on Costs |

|---|---|---|

| Routine Checkup | No deductible applicable; covered at 100% | No out-of-pocket expenses. |

| Simple X-ray | No deductible applicable; covered at 100% | No out-of-pocket expenses. |

| Broken Arm Treatment (Hospitalization) | $1,000 deductible; insured pays $1,000 before insurance coverage applies | Significant out-of-pocket expense. |

| Complex Surgery | $5,000 deductible; insured pays $5,000 before insurance coverage applies | Very high out-of-pocket expense. |

Implications on Premiums

Embedded deductibles directly influence overall premiums. Plans with higher embedded deductibles often have lower premiums to attract customers. However, this lower premium can be misleading, as it does not reflect the true cost burden on the insured individual if a significant healthcare claim arises. Insurers often use embedded deductibles to manage their expenses and make their plans more attractive to customers.

Comparison with Traditional Deductibles

Embedded deductibles, a relatively new concept, differ significantly from traditional deductibles. Understanding these distinctions is crucial for consumers to make informed decisions about their healthcare plans. This comparison explores the nuances of each approach, highlighting their advantages and disadvantages, and guiding readers towards selecting the most suitable option.Traditional deductibles, as the name suggests, are upfront costs the policyholder must meet before the insurance company begins paying for covered services.

Embedded deductibles, on the other hand, incorporate a component of the deductible within the cost of the service itself. This subtle difference in approach has important implications for how consumers experience their healthcare expenses.

Key Differences

Traditional deductibles function as a flat amount that must be met before insurance coverage kicks in. The consumer pays the entire deductible amount upfront, potentially incurring a large out-of-pocket expense before receiving any benefits from the insurance company. In contrast, embedded deductibles incorporate a percentage or a fixed amount into the price of each covered service. This can be advantageous for those who prefer more predictability in their healthcare costs.

Advantages of Embedded Deductibles

One major advantage of embedded deductibles is their ability to provide greater transparency and predictability in healthcare costs. By incorporating the deductible into the price of a service, consumers know precisely what their out-of-pocket expenses will be, leading to better financial planning. This predictability also reduces the potential for unexpected or large out-of-pocket costs. Furthermore, the upfront payment aspect might incentivize cost-conscious decision-making.

Disadvantages of Embedded Deductibles

However, embedded deductibles may not always be the optimal choice for everyone. One potential drawback is the complexity of understanding the exact amount of the deductible and how it impacts coverage. While the predictability can be a benefit, it can also lead to higher overall costs compared to traditional deductibles, depending on the frequency and extent of the needed healthcare services.

Advantages of Traditional Deductibles

Traditional deductibles offer a more straightforward approach. Consumers know the exact amount they must pay before insurance begins covering expenses. This clarity can be appealing for some, as it provides a clear financial picture.

Disadvantages of Traditional Deductibles

The upfront payment nature of traditional deductibles can be a significant disadvantage. It can lead to unexpected or large out-of-pocket expenses before coverage begins. This unpredictability can create financial stress for consumers. Furthermore, the payment of the deductible amount upfront may not be conducive to individuals who are seeking a more transparent approach to healthcare cost management.

Circumstances Where Each Type Might Be Preferable

The best choice between embedded and traditional deductibles depends heavily on individual circumstances. Individuals with a consistent need for routine healthcare services, or those who prefer predictability, might find embedded deductibles more suitable. Conversely, those with sporadic or infrequent healthcare needs, or those who prefer upfront clarity, may prefer traditional deductibles.

Summary Table

| Feature | Embedded Deductible | Traditional Deductible |

|---|---|---|

| Deductible Payment | Incorporated into service price | Paid upfront, in a lump sum |

| Transparency | High, costs are known beforehand | Relatively straightforward, but may require more calculation |

| Predictability | High, costs are predictable | Variable, depends on healthcare utilization |

| Financial Impact | Potentially higher overall cost, depending on usage | Potentially higher upfront cost, but could be lower overall |

Potential Implications and Considerations

Embedded deductibles, while seemingly convenient, can have significant impacts on consumers and the healthcare system. Understanding these implications is crucial for making informed decisions about health insurance. These hidden costs can dramatically alter how individuals and families approach healthcare, impacting both their financial well-being and their overall health.Navigating the complexities of embedded deductibles requires careful consideration of their potential effects on consumer choices, financial planning, healthcare costs, and potential pitfalls.

Understanding these considerations empowers individuals to make informed decisions and plan for the unexpected costs associated with healthcare.

Impact on Consumer Choices

Consumers might be drawn to plans with lower advertised premiums, unaware of the embedded deductible. This can lead to a skewed perception of the overall cost of care, potentially influencing choices in a way that isn’t financially prudent. In the long run, this could result in higher out-of-pocket expenses when unexpected medical events arise.

An embedded deductible means your health insurance plan’s deductible is built into your premium. It’s a bit like pre-paying for a certain amount of healthcare costs, which can be helpful in some cases. But, with all this in mind, the question of whether cancer will ever be completely cured remains a complex one, demanding continuous research and development.

Further research into potential cures, as seen in this recent article on will cancer ever be cured , is crucial. So, while embedded deductibles might seem like a good financial strategy, it’s still important to understand your plan’s specifics and what you’re actually paying for.

Impact on Financial Planning

The hidden nature of embedded deductibles can create significant challenges for financial planning. Individuals might underestimate the total cost of healthcare, potentially leading to insufficient savings or financial stress when medical bills arise. This is particularly relevant for individuals with pre-existing conditions or those facing potentially costly procedures.

Influence on Overall Health Insurance Costs

Embedded deductibles can potentially drive up overall healthcare costs. If consumers aren’t fully aware of the true cost of their coverage, they may utilize healthcare services less frequently than necessary, delaying or avoiding potentially treatable conditions. This could lead to more expensive treatments down the line, and contribute to a more costly healthcare system.

Potential Pitfalls and Challenges

One major pitfall is the lack of transparency. The complexity of embedded deductibles makes it difficult for consumers to accurately compare plans and understand their true cost. This lack of transparency can lead to unexpected expenses and financial hardship. Furthermore, consumers may be more inclined to delay or forgo necessary care, which can worsen existing health conditions and create long-term complications.

Effect on Healthcare Utilization Patterns

Embedded deductibles can significantly affect how individuals utilize healthcare services. Consumers might be less inclined to seek preventive care or routine check-ups, opting for more expensive emergency room visits or hospitalizations if their condition has worsened. This could lead to a less proactive approach to health maintenance, ultimately impacting the overall health and well-being of the population. For example, someone might delay getting a routine checkup for a nagging pain, only to find it’s a serious condition requiring expensive treatment later.

Visual Representation

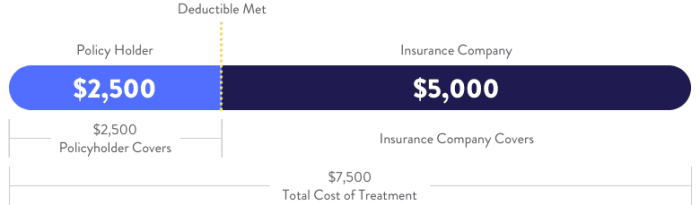

Understanding embedded deductibles can be tricky. Visual representations can greatly clarify how these deductibles work differently from traditional ones. This section offers visual aids to better grasp the concept and the process.

Graphical Depiction of an Embedded Deductible

The following diagram illustrates how an embedded deductible works. Imagine a hypothetical insurance policy with a $1,000 embedded deductible for a specific type of medical expense.

+-----------------------------------+ | Medical Expenses | +-----------------------------------+ | $1000 (Embedded Deductible) | +-----------------------------------+ | $500 (First Payment) | +-----------------------------------+ | $500 (Remaining expenses covered)| +-----------------------------------+

In this example, the first $1,000 in medical expenses are applied towards the embedded deductible.

The policyholder pays the first $500 of expenses. The insurer then covers the remaining expenses, up to the policy limits.

Comparison with Traditional Deductibles

The following table illustrates the key difference between embedded and traditional deductibles.

| Feature | Embedded Deductible | Traditional Deductible |

|---|---|---|

| Application | Deductible amount is part of the overall plan costs, deducted upfront. | Deductible is a separate amount that must be met before any coverage applies. |

| Payment Timing | Deductible is applied incrementally as expenses occur. | Deductible must be met in one lump sum. |

| Coverage Activation | Coverage is not activated until the deductible amount is met. | Coverage is activated after the deductible amount is met. |

This table highlights how embedded deductibles are factored into the cost of each service. A traditional deductible is met separately and in full before coverage kicks in.

Claim Process with Embedded Deductible

The following steps detail the typical claim process when dealing with an embedded deductible.

- Expense Incurred: The policyholder incurs medical expenses.

- Payment: The policyholder pays the portion of the expense that falls within the embedded deductible.

- Claim Submission: The policyholder submits the claim to the insurance company.

- Deductible Application: The insurance company applies the paid amount towards the embedded deductible.

- Coverage Activation: Once the embedded deductible is met, the insurer covers the remaining expenses, up to the policy limits.

This process ensures that the deductible amount is factored into the total cost of the service and the coverage is applied accordingly.

Illustrative Case Studies

Understanding how embedded deductibles function in real-world scenarios is crucial for consumers. These deductibles, often hidden within the fine print of health insurance plans, can significantly impact financial out-of-pocket costs and healthcare choices. The following case studies illustrate various aspects of their operation.

Real-World Scenario: The Healthy Individual

Jane, a 30-year-old with excellent health, opted for a health insurance plan with a low monthly premium. This plan featured an embedded deductible for routine care, such as checkups and preventive screenings. While Jane appreciated the lower premium, her initial health screenings were covered by her plan, but subsequent doctor visits were subject to the embedded deductible. She had to pay the full cost of the first few visits until the embedded deductible was met.

This experience highlighted how seemingly minor health concerns can lead to significant out-of-pocket expenses if not carefully considered.

Financial Challenges: The Unexpected Illness

Mark, a 45-year-old with a pre-existing condition, chose a plan with a seemingly attractive monthly premium. However, the plan’s embedded deductible for his condition was surprisingly high. When Mark experienced a sudden and serious illness requiring multiple specialist visits and extensive treatment, the embedded deductible quickly depleted his savings. This case demonstrates how an embedded deductible can become a significant financial burden in unexpected medical situations, especially for individuals with pre-existing conditions.

Impact on Healthcare Decisions: The Cost-Conscious Consumer

Sarah, a young professional, was looking for a budget-friendly health insurance plan. She selected a plan with an embedded deductible for most medical procedures, but not for preventive care. Recognizing the high out-of-pocket cost for non-preventive procedures, Sarah prioritized preventative care over some necessary checkups, which in the long run could lead to more serious health problems. This case study underscores how embedded deductibles can influence healthcare decisions, potentially leading to delayed or forgone necessary care to avoid financial strain.

Final Wrap-Up

In conclusion, understanding embedded deductibles is key to navigating the complexities of modern insurance. By comparing them to traditional deductibles, we’ve highlighted the nuances of how they impact claim processes and individual costs. This knowledge empowers you to make more informed decisions about your health insurance and financial planning, ultimately leading to better control over your healthcare expenses.