Pregnant with no maternity insurance what now – Pregnant with no maternity insurance? What now? This is a critical situation, and facing it alone can feel overwhelming. This guide will explore the challenges, financial resources, healthcare options, and legal considerations pregnant individuals without insurance may encounter. We’ll delve into the complexities of navigating this journey, offering practical advice and support.

This post provides a comprehensive overview of the issues surrounding pregnancy without maternity insurance, covering everything from understanding the financial implications to accessing crucial healthcare resources. We’ll look at financial aid, healthcare providers, and legal rights, and provide practical strategies to ensure a healthy pregnancy and future planning.

Understanding the Situation

Being pregnant without maternity insurance presents a significant financial and logistical challenge. Navigating the complexities of healthcare costs, doctor visits, and potential childbirth expenses can be overwhelming. This often leads to stress and anxiety, impacting both the physical and mental well-being of the expectant parent. Understanding the various aspects of this situation is crucial for proactive planning and informed decision-making.The financial burden of pregnancy without insurance coverage can be substantial.

Medical expenses, including prenatal care, childbirth, and postpartum care, can quickly accumulate. Without insurance, these costs can easily exceed savings, requiring careful budgeting and potentially impacting other aspects of life.

Financial Implications of Pregnancy Without Insurance

The lack of maternity insurance coverage can lead to substantial financial strain. Prenatal care, including doctor visits, ultrasounds, and blood tests, can be expensive. Childbirth costs, whether at a hospital or birthing center, vary significantly and can quickly exceed several thousand dollars. Postpartum care, including check-ups and potential complications, also adds to the financial burden. These expenses often come unexpectedly, making it difficult to plan ahead and create a budget.

For example, a routine prenatal checkup can easily cost several hundred dollars, and complications during pregnancy or childbirth can lead to significantly higher expenses.

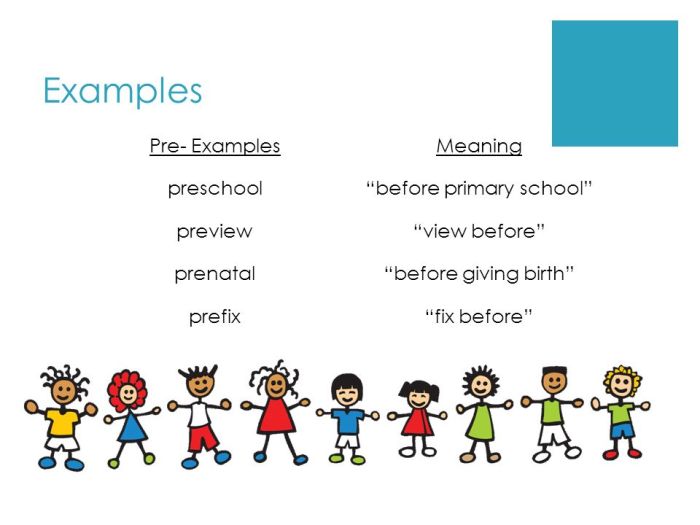

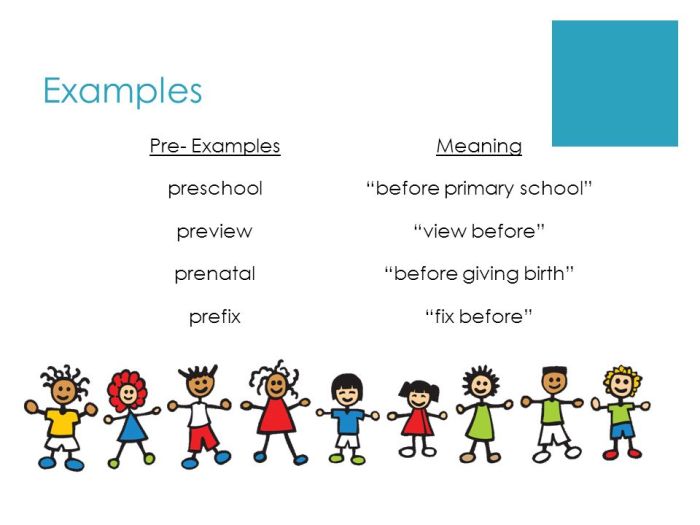

Types of Maternity Insurance and Coverage Variations

Maternity insurance comes in various forms, offering different levels of coverage. Some plans cover prenatal care and childbirth comprehensively, while others may have limited coverage or specific exclusions. Employer-sponsored plans are common, but not all employers offer them. Private insurance plans vary in their benefits, deductibles, and co-pays. The coverage offered often depends on the plan’s specific terms and conditions.

Government-funded programs like Medicaid can offer assistance for low-income pregnant individuals. Understanding the different types of insurance and their coverage details is essential for making informed decisions.

Importance of Early Planning for Financial Needs During Pregnancy

Early planning is crucial for managing the financial aspects of pregnancy without insurance. Creating a budget to account for potential expenses, exploring financial assistance programs, and understanding healthcare costs are essential steps. This planning helps in minimizing the financial stress associated with pregnancy. For example, researching and applying for Medicaid or other assistance programs early on can significantly reduce the financial burden.

Impact of Lack of Insurance on Healthcare Access and Prenatal Care

Lack of insurance can significantly impact access to healthcare and quality prenatal care. Without insurance, many individuals may delay or forgo essential prenatal visits, potentially leading to complications or adverse outcomes. This delay in care can increase the risk of health problems for both the mother and the baby. For instance, a pregnant woman might delay a necessary checkup due to the financial burden, which could lead to a more serious health issue down the line.

This highlights the importance of early intervention and financial planning.

Common Misconceptions Surrounding Maternity Insurance Coverage

A common misconception is that maternity insurance is automatically included in other health insurance plans. This is not always the case, and specific coverage details must be carefully reviewed. Another misconception is that only employers provide maternity insurance. In reality, various options exist, including individual plans and government programs. Understanding the nuances of insurance coverage is critical to avoiding unnecessary financial strain.

Financial Resources and Assistance

Navigating pregnancy without maternity insurance can feel overwhelming, especially when considering the financial burdens ahead. Understanding your options for financial aid is crucial in ensuring a smooth and supportive journey. This section will explore various avenues of support, from government assistance programs to employer-sponsored and private insurance options.Financial planning during pregnancy requires careful consideration of the costs associated with prenatal care, childbirth, and postpartum expenses.

So, you’re pregnant and haven’t got maternity insurance? It’s a tough spot, but you’re not alone. Finding affordable healthcare options and understanding potential risks like cardiac complications from certain medications, like azithromycin, zithromax, or Z-pack, is crucial. Knowing the cardiac risk associated with these antibiotics is essential for a healthy pregnancy. Check out this resource for more detailed information on cardiac risk azithromycin zithromax z pack.

Luckily, there are resources and support groups available to help navigate these challenges, and you’ll find lots of options for affordable healthcare during pregnancy. Now, back to the crucial issue of finding the right coverage for your situation.

By proactively researching and utilizing available resources, you can mitigate financial stress and focus on your well-being and the well-being of your child.

So, you’re pregnant and realized you’re uninsured for maternity care? It’s definitely a stressful situation, but you’re not alone. Finding affordable healthcare options is key, and understanding potential health concerns like thyroid disease in men can be helpful in navigating your own health during this time. thyroid disease in men can sometimes affect fertility and pregnancy outcomes, so staying informed is important.

Now, back to the issue at hand: what are your next steps to secure the best possible care for you and your baby?

Potential Financial Aid Programs

Numerous programs exist to provide financial assistance to pregnant individuals. These programs aim to help cover healthcare costs and other essential expenses during this crucial period. Exploring these options can significantly alleviate the financial strain associated with pregnancy.

- Medicaid: A joint federal and state program that provides healthcare coverage to low-income individuals and families.

- CHIP (Children’s Health Insurance Program): A federally funded program that offers health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

- WIC (Special Supplemental Nutrition Program for Women, Infants, and Children): Provides supplemental food, nutrition education, and breastfeeding support to pregnant women, new mothers, and young children.

- TANF (Temporary Assistance for Needy Families): A program offering temporary financial assistance to families with dependent children. While not solely focused on healthcare, it can provide vital support during this time.

- State-Specific Programs: Many states offer additional assistance programs specifically designed for pregnant individuals and families. These programs may provide support with housing, childcare, or other necessities.

Government Assistance Program Comparison

This table provides a concise overview of various government assistance programs, highlighting their eligibility criteria:

| Program | Eligibility Criteria (General Summary) |

|---|---|

| Medicaid | Low-income individuals and families, often with specific income and asset limits based on state guidelines. Requirements may include residency in the state and citizenship/legal residency status. |

| CHIP | Families with incomes above Medicaid eligibility but below the income threshold for private insurance, with a focus on children’s health coverage. |

| WIC | Pregnant women, new mothers, and young children who meet specific nutritional guidelines and income requirements. |

| TANF | Families with dependent children experiencing financial hardship, with varying requirements across states, including income limits and eligibility periods. |

Applying for Medicaid or CHIP

Applying for Medicaid or CHIP involves a straightforward process that can be completed online or through a local healthcare agency. These steps should be followed for a smooth application.

| Step | Action |

|---|---|

| 1 | Gather necessary documentation, including proof of income, residency, and any other relevant documents required by your state. |

| 2 | Complete the application form online or in person at a designated location, such as a local health department. |

| 3 | Submit the application and required documentation to the appropriate authority. |

| 4 | Schedule a follow-up appointment with the Medicaid or CHIP office for verification and processing. |

Exploring Employer-Sponsored Insurance Options

Investigating employer-sponsored insurance is essential if you are employed. Many employers offer health insurance plans, which can be an invaluable resource for covering pregnancy-related costs. Reviewing and understanding your employer’s options is key.

- Check Your Employer’s Policies: Contact your HR department or review your employee handbook for details on maternity benefits.

- Explore Different Plans: Assess the different insurance plans available, comparing coverage and costs.

- Enroll in a Plan: Enroll in a plan that meets your needs and budget if your employer offers one.

Private Insurance Options Outside Employer-Sponsored Programs

Exploring private insurance options outside of employer-sponsored programs is another vital step. Many insurance companies offer coverage for pregnancy and childbirth.

- Research Insurance Providers: Compare coverage, costs, and eligibility requirements across various insurance providers.

- Review Coverage Details: Carefully review the policy details for maternity coverage, including costs, limits, and specific procedures.

- Compare and Contrast: Compare the different policies to identify the best fit for your financial situation and healthcare needs.

Eligibility Criteria for Insurance Assistance Programs

Eligibility criteria vary depending on the specific program and state regulations. Income, residency, and other factors are often considered. This section highlights the criteria for each program.

- Medicaid: Income guidelines, residency requirements, and citizenship/legal residency status are commonly required.

- CHIP: Income thresholds that are above Medicaid but below private insurance premiums, coupled with residency and citizenship/legal residency status are often involved.

- Private Insurance Assistance Programs: Specific income, employment status, and other factors can influence eligibility for private insurance assistance programs.

Healthcare Access and Options

Navigating pregnancy without insurance can feel daunting, but it’s crucial to remember you’re not alone and options exist. Understanding your healthcare choices is the first step toward a positive and healthy pregnancy. Many resources are available to help you access affordable care.Finding the right healthcare providers and support systems is essential for a smooth pregnancy journey. This section details various options, from community clinics to healthcare providers who accept payment plans, empowering you to make informed decisions.

Healthcare Providers Offering Assistance

Many healthcare providers understand the unique challenges of uninsured pregnant individuals. Hospitals and clinics often have programs to assist those with limited financial resources. These programs can involve discounted services or waivers for certain procedures. Visiting a local health department can provide information on these programs and identify providers who offer assistance.

Community Resources and Support Groups

Community resources play a vital role in supporting pregnant individuals without insurance. These resources can provide crucial information and support. Local health departments, social service agencies, and non-profit organizations frequently offer counseling, classes, and other forms of support for pregnant women. Support groups, often facilitated by local organizations, offer a space for women to connect with peers, share experiences, and receive encouragement.

Comparison of Healthcare Options

| Healthcare Option | Description | Potential Costs |

|---|---|---|

| Free or Low-Cost Clinics | Clinics offering prenatal care at reduced or no cost. | Usually free or significantly reduced compared to private providers. |

| Hospital-Based Programs | Programs within hospitals designed to assist low-income pregnant individuals. | May involve a co-pay or reduced fee structure, depending on the specific program. |

| Private Providers Accepting Payment Plans | Private doctors or midwives who offer payment plans. | Cost varies depending on the provider and the plan agreed upon. |

Finding Low-Cost or Free Prenatal Care Clinics

Locating free or low-cost prenatal care clinics requires proactive research. Start by contacting your local health department, visiting the websites of community health centers, or searching online for “free prenatal care clinics near me.” Many organizations provide listings of such clinics. These resources often offer essential support during pregnancy, including medical check-ups, nutrition counseling, and childbirth education.

Importance of Considering Different Prenatal Care Options

Different prenatal care options cater to diverse needs and circumstances. Comparing costs and services offered by various providers is crucial. Factors like location, hours of operation, and the type of care provided (e.g., prenatal visits, ultrasounds, delivery services) should be considered. This comprehensive approach helps in making informed decisions aligned with individual financial and health needs.

Locating Healthcare Providers Accepting Payment Plans, Pregnant with no maternity insurance what now

Many healthcare providers are willing to work with patients on payment plans. When contacting potential providers, inquire about their policies regarding payment plans. Some providers might have different payment arrangements or reduced fees for specific services. You may need to be prepared to provide documentation of your income and financial situation.

Legal and Policy Considerations: Pregnant With No Maternity Insurance What Now

Navigating the complexities of pregnancy without maternity insurance often involves understanding your legal rights and state policies. This section delves into the crucial legal protections available to pregnant individuals, highlighting state-specific regulations and the impact of these policies on affordability. Understanding your rights and resources can significantly ease the financial and emotional burden of this challenging period.Legal protections for pregnant individuals regarding healthcare access vary significantly between states.

Federal laws, while crucial, are often supplemented by state-level policies. These regulations, along with the availability of public programs, can drastically influence the financial aspects of pregnancy care.

Legal Rights of Pregnant Individuals Regarding Healthcare Access

Pregnant individuals have legal rights to essential healthcare services, even without insurance. These rights are rooted in both federal and state laws. Federal laws, like the Affordable Care Act (ACA), aim to provide access to healthcare services. However, the specifics of how these rights are enforced and the extent of coverage vary significantly by state.

So, you’re pregnant and don’t have maternity insurance? It’s a tough situation, but you’re not alone. Finding affordable prenatal care and managing the costs can be a real worry. Luckily, focusing on your overall health, including your skin, can help you feel better during this time. Consider incorporating some simple, at-home techniques like gentle exfoliation and hydration to improve skin texture.

For more detailed tips on how to improve skin texture, check out this helpful guide: how to improve skin texture. Remember, taking care of your well-being, both inside and out, is key as you navigate this exciting but sometimes challenging time.

State Policies Regarding Healthcare for Pregnant Individuals

State policies play a critical role in shaping healthcare access for pregnant individuals. Some states offer extensive Medicaid programs that cover prenatal care, childbirth, and postpartum services for low-income individuals. Conversely, other states have less robust programs, potentially leaving pregnant individuals without adequate coverage.

Potential Impact of Policies on Healthcare Affordability

State policies regarding healthcare for pregnant individuals directly impact affordability. Robust state-level programs can make prenatal care, childbirth, and postpartum services more accessible and affordable. Conversely, states with limited programs or high administrative burdens can create significant financial challenges for pregnant individuals. For example, a state with strict eligibility criteria for Medicaid may exclude many low-income individuals, leaving them unable to afford crucial medical care.

Importance of Understanding Legal Rights Related to Insurance

Understanding your legal rights related to insurance is paramount. Knowledge of the specific provisions in your state’s laws empowers you to seek appropriate medical care without undue financial strain. Knowing your rights allows you to advocate for your needs and ensures you are not denied essential services.

Comparison and Contrast of Differences in Legal Rights Between States

Differences in legal rights between states are significant. For instance, some states have laws specifically protecting pregnant individuals from discrimination in healthcare settings, while others may not. The availability and breadth of Medicaid coverage also vary greatly. The lack of uniformity in state laws creates a patchwork of protections and challenges for pregnant individuals across the country.

A pregnant individual in one state may have greater access to coverage than someone in another, despite facing similar financial limitations.

Role of Advocacy Groups in Advocating for Pregnant Individuals Without Insurance

Advocacy groups play a critical role in advocating for pregnant individuals without insurance. These groups work to raise awareness about the legal rights of pregnant individuals and to advocate for policy changes that improve access to affordable healthcare. They often provide crucial support, resources, and legal assistance to those in need. For example, the National Advocates for Pregnant Women (NAPW) actively works to protect the rights of pregnant individuals in legal and policy arenas.

Long-Term Planning and Prevention

Navigating pregnancy without insurance can be a daunting experience, but proactive planning can significantly mitigate future challenges. Understanding the financial and healthcare implications of unplanned pregnancies is crucial for long-term well-being and peace of mind. This section focuses on preventive measures and financial strategies to ensure a smoother path for future pregnancies.

Actions to Avoid Future Situations

Proactive planning is key to avoiding similar situations in the future. This involves a multi-faceted approach encompassing financial preparedness, healthcare access, and personal choices. A comprehensive understanding of these areas can significantly reduce the stress and anxiety associated with unexpected pregnancies.

- Develop a comprehensive budget: Regularly track income and expenses to identify areas for potential savings and establish a clear understanding of your financial capacity.

- Explore affordable healthcare options: Research and compare various healthcare plans, including community health clinics, health insurance marketplaces, and other public programs, to find the most suitable option for your needs.

- Utilize family planning resources: Understanding and utilizing birth control methods effectively can significantly reduce the likelihood of unplanned pregnancies.

- Build an emergency fund: Establish a dedicated savings account to cover unexpected medical expenses and other potential costs associated with pregnancy and childbirth.

- Educate yourself on reproductive health: Stay informed about reproductive health options, including family planning methods, to make informed decisions.

Financial Planning Guide for Future Pregnancies

Financial planning for future pregnancies is vital to ensure the financial well-being of both you and your child. This involves budgeting, saving, and understanding potential expenses.

- Create a detailed budget: Allocate specific funds for prenatal care, childbirth expenses, and childcare costs. Account for potential variations in costs.

- Establish a savings plan: Regularly contribute to a dedicated savings account for future pregnancies. Even small, consistent contributions can make a significant difference.

- Explore potential financial assistance programs: Research government assistance programs and private organizations offering support for pregnant individuals.

- Seek guidance from financial advisors: Consult with a financial advisor to develop a personalized plan tailored to your specific financial situation and goals.

Importance of Considering Pregnancy as a Life Event

Recognizing pregnancy as a significant life event with financial implications is crucial for comprehensive planning. This involves understanding potential costs and proactively seeking solutions.

Considering pregnancy as a potential life event and preparing financially beforehand can significantly reduce stress and anxiety associated with unforeseen circumstances.

Resources for Affordable Healthcare Options

Numerous resources can help individuals access affordable healthcare options. These resources include government programs, community clinics, and non-profit organizations.

- Healthcare.gov: The official website for health insurance marketplaces in the United States provides information about various plans and assistance programs.

- Local community health centers: These centers offer affordable healthcare services, including prenatal care, to underserved populations.

- Medicaid and CHIP: Government programs providing healthcare coverage for low-income individuals and families.

Affordable Insurance Options by Age Group

| Age Group | Insurance Option Examples | Potential Considerations |

|---|---|---|

| 18-24 | Health insurance marketplaces, Medicaid, community health clinics | Young adults may qualify for specific programs based on income and family status. |

| 25-34 | Health insurance marketplaces, employer-sponsored insurance, short-term plans | Many individuals in this age group may have access to employer-sponsored insurance. |

| 35-44 | Health insurance marketplaces, employer-sponsored insurance, individual plans | Individuals may face higher premiums due to age, but options exist through marketplaces and other sources. |

| 45+ | Health insurance marketplaces, individual plans, Medicare (for those eligible) | Premiums are typically higher in this age group. |

Understanding Insurance Coverage in the Long Term

Understanding the long-term implications of insurance coverage is essential for making informed decisions. This involves evaluating coverage options, examining policy details, and comparing different plans.

Thoroughly understanding insurance coverage, including deductibles, co-pays, and coverage limits, is vital for making sound financial decisions.

Illustrative Scenarios and Examples

Navigating pregnancy without insurance can feel overwhelming, but understanding the available resources and options can make a significant difference. This section provides realistic scenarios to illustrate how to access financial aid, healthcare, and community support. These examples demonstrate the practical steps involved in each situation.

A Scenario: Facing Financial Hardship During Pregnancy

A single mother, Sarah, works part-time and struggles to make ends meet. Her job doesn’t offer health insurance, and her savings are dwindling. She’s in her second trimester and anticipates significant medical expenses during pregnancy and childbirth. She needs immediate financial assistance to cover prenatal care, medication, and potential complications. Sarah’s situation highlights the importance of early intervention and accessing financial aid programs.

Navigating Healthcare Options with Financial Constraints

When facing financial limitations, pregnant individuals must proactively explore healthcare options. Choosing a healthcare provider is crucial. Public health clinics and hospitals often offer reduced-cost or free services. For instance, local health departments may provide prenatal care, including screenings and vaccinations, at a fraction of the cost. Additionally, some hospitals may have financial assistance programs or partnerships with community organizations to ease the burden on expecting parents.

Accessing Community Resources for Support

Community resources play a vital role in supporting pregnant individuals facing financial challenges. These resources can provide a wide range of assistance, from food banks to childcare assistance. Local organizations, such as churches, community centers, and non-profit groups, often have programs specifically designed to aid pregnant women and families. For example, a local food bank might offer nutritional counseling, while a community center could provide parenting classes and support groups.

Types of Support Groups for Pregnant Individuals

Support groups provide a vital network for pregnant individuals. These groups can offer emotional support, practical advice, and a sense of community. They can be organized by location, ethnicity, or shared circumstances. Support groups can be structured around shared experiences, such as single parenthood, chronic conditions, or cultural backgrounds. These groups can also provide valuable insights into navigating the challenges of pregnancy and childbirth.

There are also online forums and support groups that can connect individuals with similar experiences.

Illustrative Example: Applying for a Financial Aid Program

A financial aid program, like the Medicaid program, can significantly alleviate the financial burden of pregnancy. The application process typically involves providing documentation of income, residency, and other relevant information. The program will evaluate the submitted documentation to determine eligibility and the amount of assistance available. For example, the application might require proof of income, such as pay stubs or tax returns, and proof of residency, such as utility bills or lease agreements.

Each state has specific requirements, and local health departments can offer guidance on the application process.

Utilizing Government Programs for Aid

Government programs offer a range of financial and healthcare assistance to pregnant individuals. For example, the Supplemental Nutrition Assistance Program (SNAP) provides food assistance to low-income families, while the Temporary Assistance for Needy Families (TANF) program offers temporary financial assistance for families with children. These programs can be accessed through local social service agencies. Understanding the eligibility criteria and application process is crucial.

A local social worker or counselor can guide you through the process.

Final Review

Navigating pregnancy without maternity insurance requires careful planning, proactive research, and utilizing available resources. By understanding the challenges, accessing financial aid, exploring healthcare options, and understanding legal rights, expectant parents can navigate this journey with greater confidence and peace of mind. This post provides a strong foundation for making informed decisions during a potentially vulnerable time.